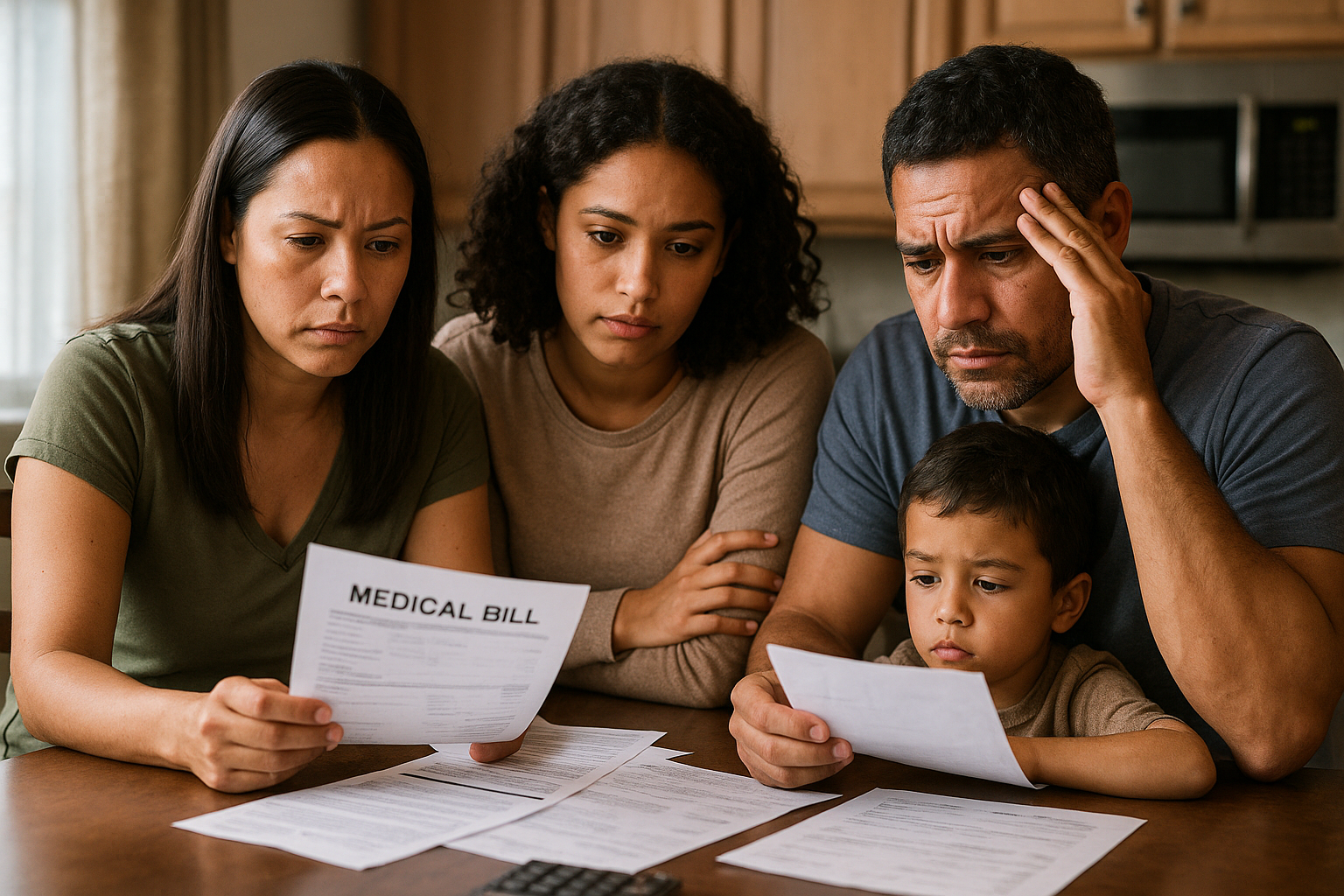

This week, a federal judge ruled that medical debt can continue to appear on Americans’ credit reports. If that sounds complicated, here’s what’s really going on — and how it impacts you.

What Changed?

Actually… not much — and that’s the problem.

Consumer advocates have been pushing for years to get medical debt off credit reports entirely, arguing it’s often unfair, inaccurate, or misleading. Medical bills are complicated, prone to billing errors, insurance mix-ups, and unexpected charges you may not even know about. Yet, they’ve historically been treated like any other debt on your credit report — hurting your score and potentially blocking you from getting approved for credit, housing, or even a job.

This ruling means that, legally, credit bureaus can keep reporting medical debt — even if consumer protection groups think it shouldn’t be there.

Who’s Impacted?

- People with unpaid or disputed medical bills

- Those who’ve been caught in the insurance shuffle (think surprise bills)

- Anyone struggling with unexpected medical costs

And let’s be honest — that’s a lot of us.

Why It Matters

Your credit report isn’t just a list of debts. It’s your financial reputation. Medical debt showing up on that report can tank your score, even if it was the result of a billing error or insurance delay. And this judge’s ruling keeps the burden on you — the consumer — to fight it.

What Can You Do?

The good news? You don’t have to take this lying down.

- Know What’s On Your Report – Check all three bureaus — Equifax, Experian, and TransUnion — free at annualcreditreport.com. (Hatch Credit pulls your reports for you when you sign up).

- Challenge What’s Unfair

Even if a debt is technically “accurate,” Hatch Credit can help you challenge negative items on your report that are unfair, unverifiable, or outdated — including medical bills. - Make Your Voice Heard

Credit bureaus don’t always want to listen. We know how to make them listen. We work directly with the bureaus and creditors to ask the tough questions and fight for fair reporting .

How Hatch Credit Can Help

We specialize in making sure your credit report actually reflects you. Whether it’s disputing outdated medical collections, asking the hard questions about a creditor’s right to report a debt, or pushing for removals based on fairness — this is what we do every day .

We’re here because we believe in credit fairness. And because no one should have to carry the weight of medical debt mistakes on their financial back.

Check your report. Tell us your story. Let’s get to work.